Before anyone can purchase shares listed in the Singapore’s stock market, one needs to first to open a Direct Securities Account with The Central Depository (CDP) which is a wholly owned subsidiary of the Singapore Exchange Ltd (“SGX”). Services provided include integrated clearing, settlement and depository facilities for customers in the Singapore Securities Market, including both equities and fixed income instruments. An investor can view and manage the investments he/she has with multiple brokers through a single CDP Securities Account.

Opening a CDP account is free of charge and can be opened with a local broker.The CDP is basically a place where all the shares you have bought in the local stock market are ‘kept’. To open a CDP account, you must be at least 18 years old and not be an un-discharged bankrupt. You can open an account either by:

- Opening a Direct Securities Account directly with CDP via their Customer Service Counters, or,

- Opening a sub-account with Depository Agents, which are the Brokerage Firms, a.k.a Brokers.

Fee charges by CDP, SGX and Brokerage

While opening and linking of individual CDP account are free, there will be fees imposed on the transactions you make in future:

- CDP clearing fee: 0.04% of contract value, subject to a maximum of S$600 (except for structured warrants which is at 0.05% of the contract value, subject to a cap of S$200)

- SGX trading access fee: 0.0075% of contract value

- Brokers’ commission (fully negotiable so talk to your Remisier!!!; minimum of S$25 for online trades)

- Prevailing Goods and Services tax (GST) on brokers’ commission, clearing fees and SGX trading access fees

Required Documents

- Broking Account Application form, CDP Application Form and CDP Linkage Form (which are available from the broking firms)

- CDP Account Number (for existing CDP account holder)

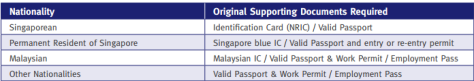

- Identification documents

- Income documents (upon request only)

- CPF Investment account number (If you wish to invest using your CPF funds)

Notes for Foreigners:

- If you are overseas, you can send your completed application form together with the certified true copies of the supporting documents to CDP for account opening

- A Notary Public or Commissioner of Oaths has to endorse your account opening forms

- An initial deposit for your broking account may be required

Direct Crediting Services

This mandatory CDP service basically allows an investor to receive Singapore-dollar dividend payments or other cash distributions, credited directly into his/her designated bank account. You can choose from one of the following participating banks in Singapore:

- Citibank

- DBS/POSB

- HSBC

- OCBC

- Standard Chartered Bank

- UOB

For more information on CDP, kindly visit https://www1.cdp.sgx.com/sgx-cdp-web/login

To find out more on opening a Brokerage Account, visit https://beyourownportfoliomanager.wordpress.com/how-to-invest/opening-a-brokerage-account/

To find out on how to invest using CPFIS (Investment Scheme) and Supplementary Retirement Scheme (SRS) and their related tax benefits, do visit https://beyourownportfoliomanager.wordpress.com/how-to-invest/using-cpf/